Summary

As the GTA industrial real estate market continues to tighten, how exactly can you and your corporation take advantage of elevated asset prices? Our goal in issuing this whitepaper is to facilitate a conversation regarding how a sale-leaseback may be an attractive tool or solution for you. Please reach out to our team if you’d like to learn more about any of the topics discussed in this paper.

GTA Industrial Market Overview & The Increasing Popularity of Sale-Leaseback Transactions

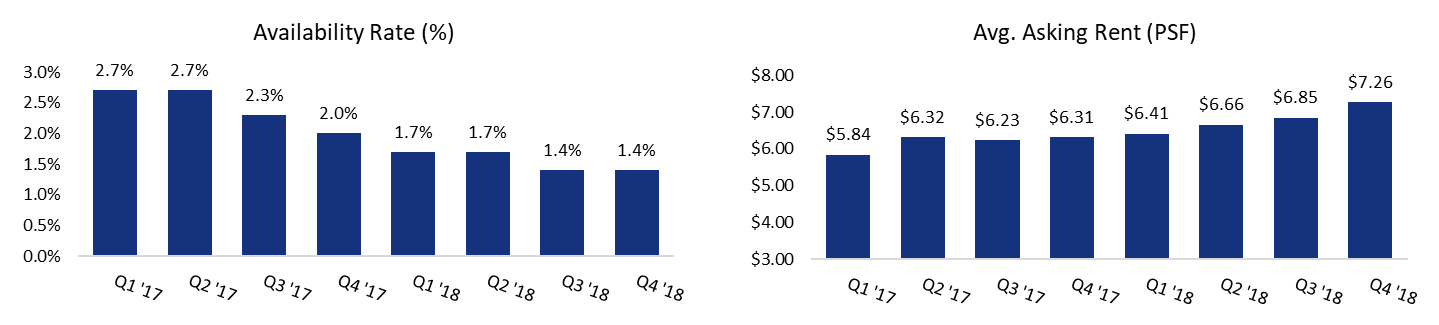

The GTA industrial market continues to see robust fundamentals such as limited availability, inadequate supply, strong absorption, and increasing rental rates. As of Q4 2018, the overall availability rate decreased to 1.4%, pushing rental rates up to $7.26 PSF – a 15% increase year-over-year[1], as seen below.

This continued market strength has led to significant cap rate compression and elevated asset prices across the GTA, presenting the opportunity for many owner-occupiers or corporations with real estate holdings to capitalize on top-of-market prices by executing a sale-leaseback.

What Exactly Is A Sale-Leaseback?

In its basic form, a sale-leaseback transaction occurs when a corporation sells real estate or other long-term assets used in its business to a third party. Additionally, as part of the transaction, the property is then leased back to the seller for a mutually agreed-upon term and rate[2].

What Are the Benefits of a Sale-Leaseback?

- Convert Equity into Cash[3]

- Allows the seller to increase working capital while retaining use of the property

- Offers owner-operators the flexibility to make larger investments in their core business to generate a higher rate of return

- Tax Savings[4]

- Allows the seller to write off their total lease payments as an expense for tax purposes. As a property owner, one can deduct only interest and depreciation expense

- Attractive Lease Terms & Control of Real Estate[5]

- Allows the seller the opportunity to negotiate preferential lease terms including extension options, early termination fees and more

- Because sale-leaseback agreements are typically structured as triple-net leases, the tenant or seller, will be responsible for taxes, insurance and maintenance. This provides the seller with similar control over the property as was the case when previously owned

Contact Us

Whether you are interested executing a sale-leaseback transaction, interested in capitalizing on current market values, or have an alternate reason to sell your industrial asset, we can assist. Contact us to facilitate a conversation on the contents of this paper or to develop a solution that works best based on your needs.

Connect with us on LinkedIn at http://www.linkedin.com/company/maroda.

TJ Tersigni

President

Maroda Property Investments

+1 416 999 3024

tj@marodaproperty.com

Footnotes

- Source: Colliers International, Greater Toronto Area Industrial Market Q1 2017 – Q4 2018 Report ↑

- Source: Sale-Leaseback Solutions by Donald J. Valachi, CCIM, CPA ↑

- Source: Sale-Leaseback Solutions by Donald J. Valachi, CCIM, CPA ↑

- Source: Sale-Leaseback Transaction – Why, When and How by Joshua Fox ↑

- Source: Sale-Leaseback Solutions by Donald J. Valachi, CCIM, CPA ↑